Growing up Latina, many of us were taught one thing: put your money in the bank. It’s “safe,” it’s “smart,” and it’s what good, responsible people do. Our parents did it. Our grandparents did it. And now…we do it too.

But what if I told you that the bank isn’t where the bank keeps its money?

Let that sink in for a moment.

When I sit down with families—moms, dads, hardworking professionals, small business owners—I always ask, “Out of these six steps to financial independence, what’s most important to you and your family?” And most often, the answer is simple: “I want to save for my future. I want to build wealth.”

So I ask a follow-up:

“Have you ever thought about where the banks save their money?”

Most people haven’t.

And when I show them, their entire perspective changes.

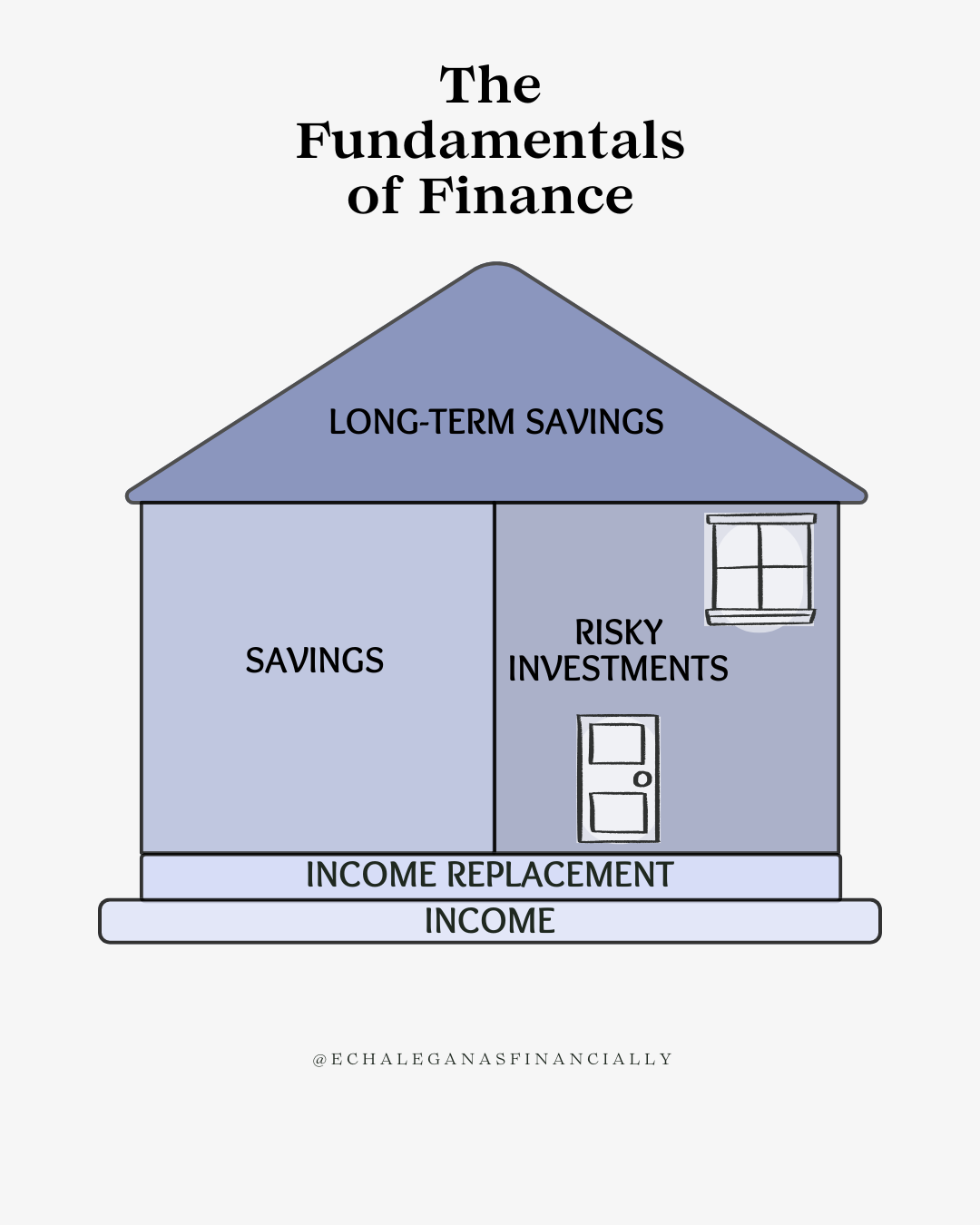

Here’s the Concept

Let’s break it down, step by step.

You deposit your hard-earned money into a traditional bank account. The bank thanks you and gives you 0.5% or maybe 1% interest for borrowing your money. (Yes, when you deposit money, you’re actually lending it to the bank.)

But what does the bank do next?

They turn around and invest your money into life insurance companies, specifically into Bank-Owned Life Insurance (BOLI). They’re earning way more than they’re giving you, growing their money tax-free, and using that cash to lend you money again—this time at 24% interest via credit cards, student loans, car loans, business loans, you name it.

So, to recap:

- You loan them money at 1%.

- They loan it back to you at 24%.

- They invest it in life insurance, make tax-free gains, and get even richer.

And we keep accepting that.

This Should Be Illegal (But It’s Not)

This system is designed to benefit the institution—not the individual.

And the worst part? We’ve bought into it. We believe it’s the only way.

We accept it because we weren’t taught there was another option.

Well, there is.

Becoming Your Own Bank

You can cut out the middleman and do exactly what the banks do—but for your family.

It’s called Becoming Your Own Bank, and we do it by using a financial vehicle called Indexed Universal Life Insurance (IUL).

This strategy allows you to:

- Grow your money tax-free

- Access your money without penalties

- Protect your family with a life insurance benefit

- Avoid the market crashes (your money is indexed, not invested)

Imagine becoming the Bank of Maria, the Bank of José, the Bank of YOU.

Your money grows for you.

You control it.

You leverage it.

So Why Not Just Stick to a 401(k)?

401(k)s are popular. They’re marketed hard. But they come with rules:

You can’t touch your money without penalties until 59½.

You get taxed in retirement when you take it out.

You’re fully exposed to market risk.

And if taxes go up in the future—which most experts agree they will—you’ll owe even more.

So I sit down and I ask:

“Would you rather do what the bank tells you to do… or do what the bank actually does?”

When people understand the difference, the choice becomes obvious.

This is About Our Community

The truth is, many Latino families are left out of these conversations.

We’re busy. We’re working hard. We’re doing everything we can to build a better life. But no one ever pulled us aside and said, “Hey, there’s another way.”

That’s what I do now.

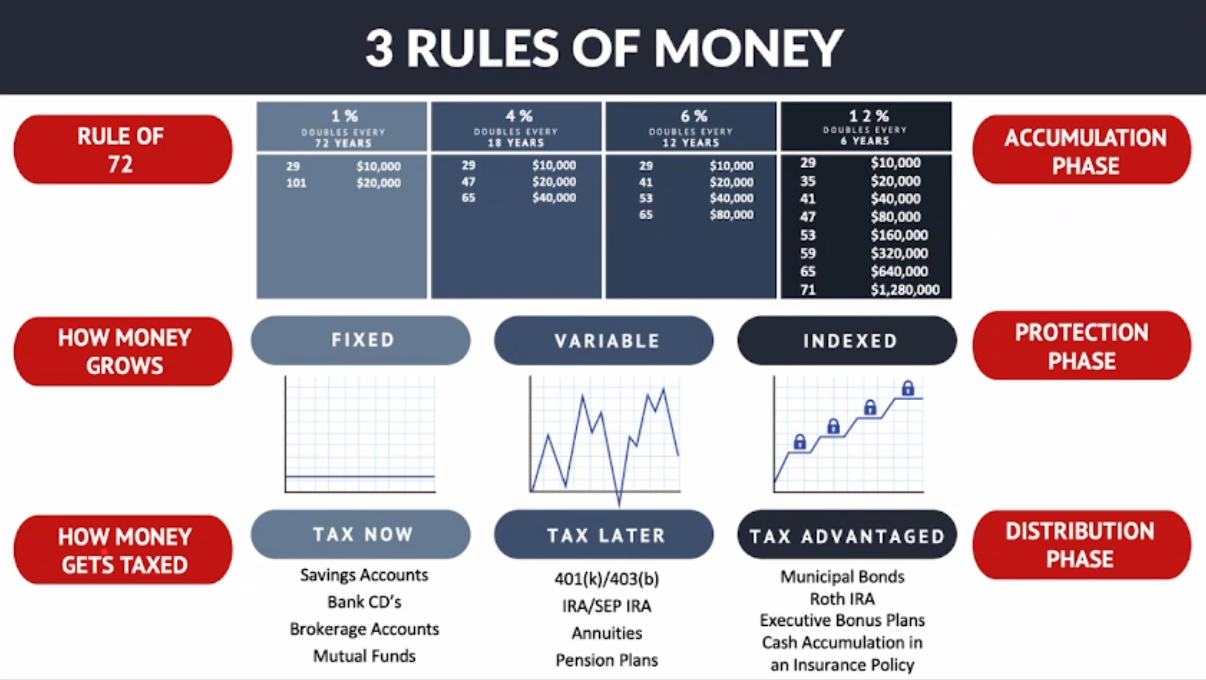

I educate. I share the real rules of money. I help people like you and me learn how to protect our income, grow real wealth, and create generational change.

Ready to Learn More?

If you’ve ever thought, “There has to be a better way,”—you were right.

Let’s talk. I’ll show you what the banks do, how they do it, and how you can apply the same strategy for your family.

Be your own bank. Because you deserve to sit on the same side of the table.

Leave a Reply