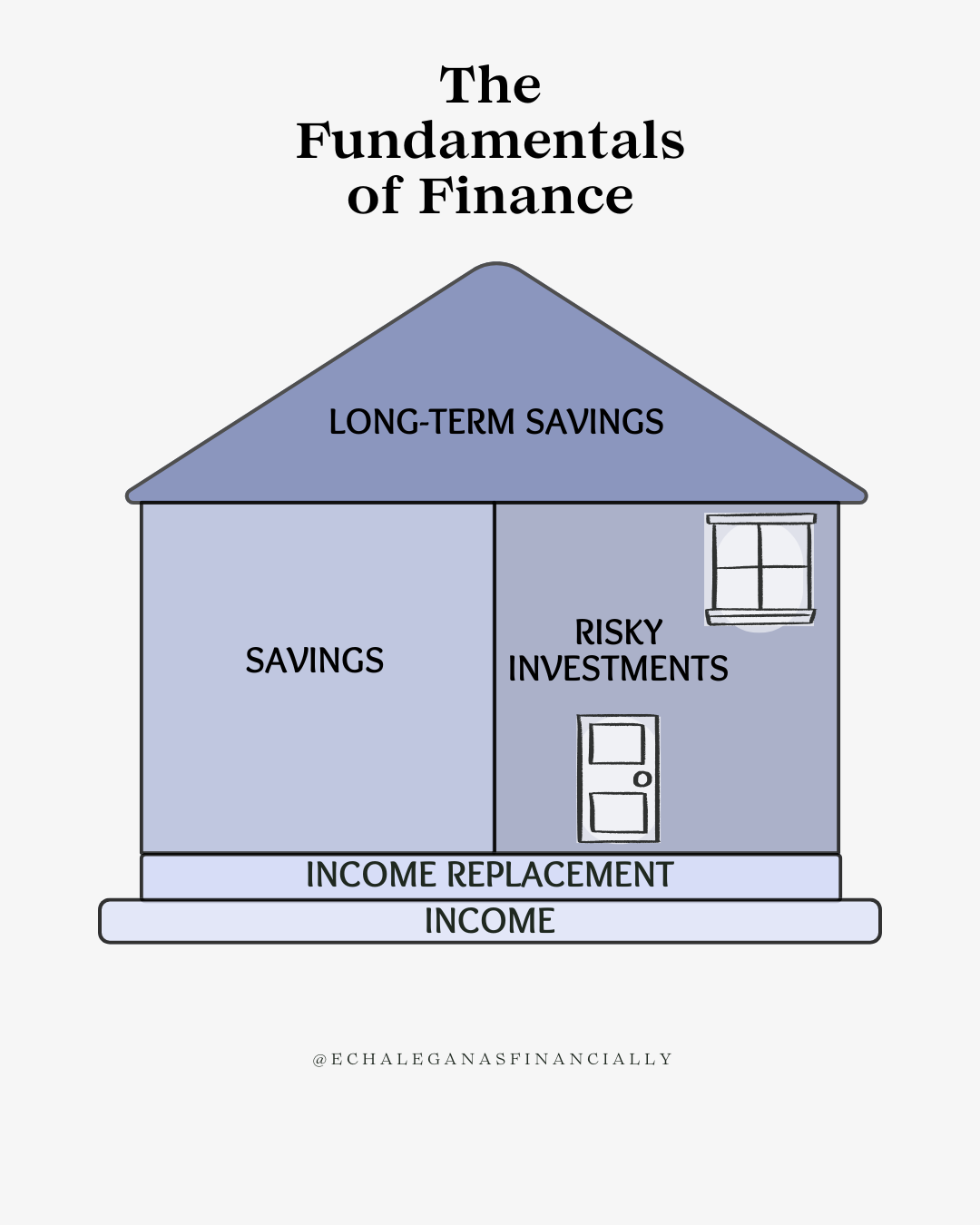

When I first started learning about money, I didn’t have a manual—just my family, my struggles, and a lot of trial and error. Over time, I realized that managing money is a lot like building a house. Every part serves a purpose—and skipping one puts the entire structure at risk.

Here’s how I’ve come to understand the fundamentals of finance through my own journey:

1. Foundation: Income

For me, everything started with earning an income at KRGV Channel 5 News. I loved my time there—telling stories about the incredible people of the Rio Grande Valley gave me purpose and pride. That job helped me build a solid financial foundation—not just through a paycheck, but by teaching me discipline, responsibility, and how to manage money once it started coming in.

Later, I expanded into other ventures—real estate investing with my family and starting my financial coaching business. Each new income stream added strength to my foundation and helped me realize something important: having just one source of income often isn’t enough to create real security.

Your job or business is the base of everything. It’s what holds your financial house up.

But if you’re living paycheck to paycheck, and your expenses are just as high as your income, there’s no room to grow. No cushion. No strategy. No peace of mind.

You either have to lower your expenses or increase your income.

That’s something I can help you with.

Schedule a free consultation with me, and I’ll walk you through how to:

- Create a custom budget that works for you

- Pay off or manage debt

- Build an emergency cushion

- And if needed, increase your income through new opportunities

In fact, I’m currently growing my team. If you qualify, I can work with you on a referral or part-time basis—helping you build your own financial foundation while serving others.

2. Floor: Income Replacement

After witnessing too many families suffer financially when tragedy struck—including the story of my friend Randy, whose father passed away with the wrong type of life insurance—I realized that earning money isn’t enough. You have to protect it, too.

That experience changed everything for me. I took a hard look at my own finances, got properly covered with life insurance, built an emergency fund, and made sure that if anything ever happened to me, my loved ones wouldn’t be left struggling.

It’s not just about peace of mind.

It’s about responsibility.

Think about it:

- We insure our cars.

- We insure our phones.

- But we forget to insure ourselves?

Let me ask you:

Who’s the money-making machine in your family?

….

You are, right?

So how would it feel if that machine suddenly broke down—and wasn’t insured?

If your income stopped because of an emergency, disability, or death… who would carry that burden?

That’s why income protection matters. It’s the floor of your financial house—it holds everything up when life shakes the ground beneath you.

Here’s something most people don’t know:

There’s an old kind of life insurance… and there’s a new kind.

- The old kind only pays after you die.

- The new kind comes with living benefits—it can pay while you’re alive if you become critically or chronically ill.

Think of it as life insurance with benefits you don’t have to die to use.

So imagine this:

You’re in a serious accident. You survive—but you’re bedridden and can’t work. Your bills don’t stop. Rent, groceries, medical expenses… they pile up.

But if you have the right coverage? You won’t have to drain your savings or rely on GoFundMe.

This isn’t about fear. It’s about freedom.

Let’s make sure your income is protected—so you and your family always have a solid floor to stand on. And if you’re passionate about helping others, I’m also training new team members who want to make a real impact.

3. Walls: Savings

Growing up, I helped my parents manage rental properties. That meant patching leaky pipes, handling last-minute cancellations, and constantly figuring out how to stretch dollars.

These everyday decisions may not seem flashy—but they’re the walls of your financial house. The structure that holds everything together.

Think short-term:

- Your monthly budget

- Your spending habits

- Your emergency savings

If the foundation is your income, and the floor is income protection, then the walls are your daily money habits. They give your finances structure and strength.

I get it—saving can be hard. Especially if you love to spend (I do too). But here’s a trick that works wonders and takes the stress out of saving:

Have your employer deposit 70% of your paycheck into your checking account (for bills and everyday spending), and 30% into a separate savings account—ideally at a different bank, preferably one with a higher interest rate.

Out of sight, out of mind.

No stress. No second-guessing. Just automatic savings.

And if 30% feels like too much right now?

- Start with 10%.

- Start with $10.

- Start with a dollar.

The most important thing is to start.

Let’s build a savings plan that actually fits your lifestyle, income, and goals—whether it’s peace of mind, travel, or just breathing room between paychecks.

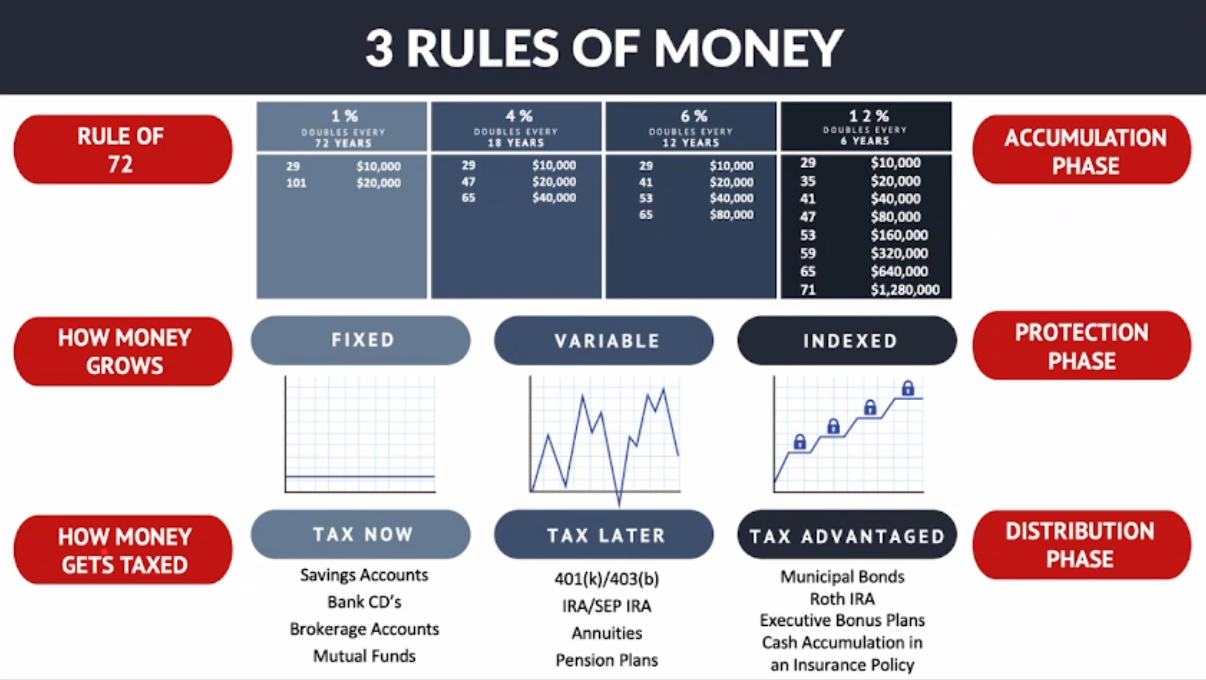

4. Roof: Long-Term Savings

When I started flipping homes with my brother, it wasn’t just about quick profits—it was about building a future. That’s when I started learning about long-term investing, retirement planning, and systems that pay off years from now.

This is your roof. The thing that protects everything underneath it.

Every decision I make today—whether it’s investing in real estate, contributing to my savings, or growing my business—is part of my blueprint for long-term financial freedom.

But let’s be real:

Too many people wait until it’s too late to plan for retirement.

I’ve seen it firsthand.

- My dad is over 70 and still can’t retire.

- My mom is over 60 and still working.

It’s not because they didn’t work hard.

It’s because no one ever showed them the right tools.

And the truth is:

- The U.S. is trillions of dollars in debt

- Social Security is underfunded

- Medicare is strained

- Companies don’t offer pensions like they used to

So what do we do?

We build our own.

You can actually set up your own pension.

You can create income for life with the right plan.

And the best part?

- No early withdrawal penalties

- Tax-free growth

- Tax-free withdrawals

- Flexibility based on your goals—not government rules

Whether you’re just getting started or approaching retirement, I can help you build the roof that protects your future.

It’s not about how much you make.

It’s about how much you keep.

Maybe one day, you’ll work because you want to—not because you have to.

That’s what financial independence really means.

- Freedom to choose your work

- Freedom to choose your lifestyle

- Freedom to choose your time

- Freedom to leave a legacy

Let’s build it together.

5. Doors & Windows: Risky Investments

Not every risk I’ve taken has worked out.

- I’ve made investments that flopped.

- Tried side hustles that fizzled.

- Poured time and money into ventures that didn’t return what I’d hoped for.

But I never crumbled.

Why?

Because my foundation was solid.

My walls, floor, and roof were already in place.

Risky investments are like the doors and windows of your financial house.

They bring in light, fresh air, and new opportunities—but they’re not the first things you build.

These are the finishing touches—not the foundation.

- Stocks

- Crypto

- Side hustles

- Real estate flips

All of these can help grow your wealth—but only after you’ve built your financial house on steady ground.

So ask yourself:

- Is your income protected?

- Do you have an emergency fund?

- Are you budgeting and saving consistently?

- Is your long-term plan in place?

If not, start there.

Then when your house is strong—you can open the doors and windows with confidence.

Financial freedom doesn’t come from chasing the next big thing.

It comes from building something solid—one smart step at a time.

Final Thought

You can’t build wealth on shaky ground.

My financial journey hasn’t been perfect, but it’s been intentional. And that’s what I want for you, too.

- Start with your foundation.

- Protect your income.

- Build strong walls and a roof.

- Take calculated risks—only when you’re ready.

Want help building your financial house?

Let’s talk.

Schedule your free financial consultation.

I’ll meet you where you are—and help you build from there.

Leave a Reply