When I sit down with clients to talk about retirement, the 401(k) always comes up. It’s the most common savings vehicle—especially for younger professionals. But how well do most people actually understand the rules… or the long-term consequences?

Let’s break it down.

The Truth About the 401(k): Variable, Tax-Deferred, and Limited Control

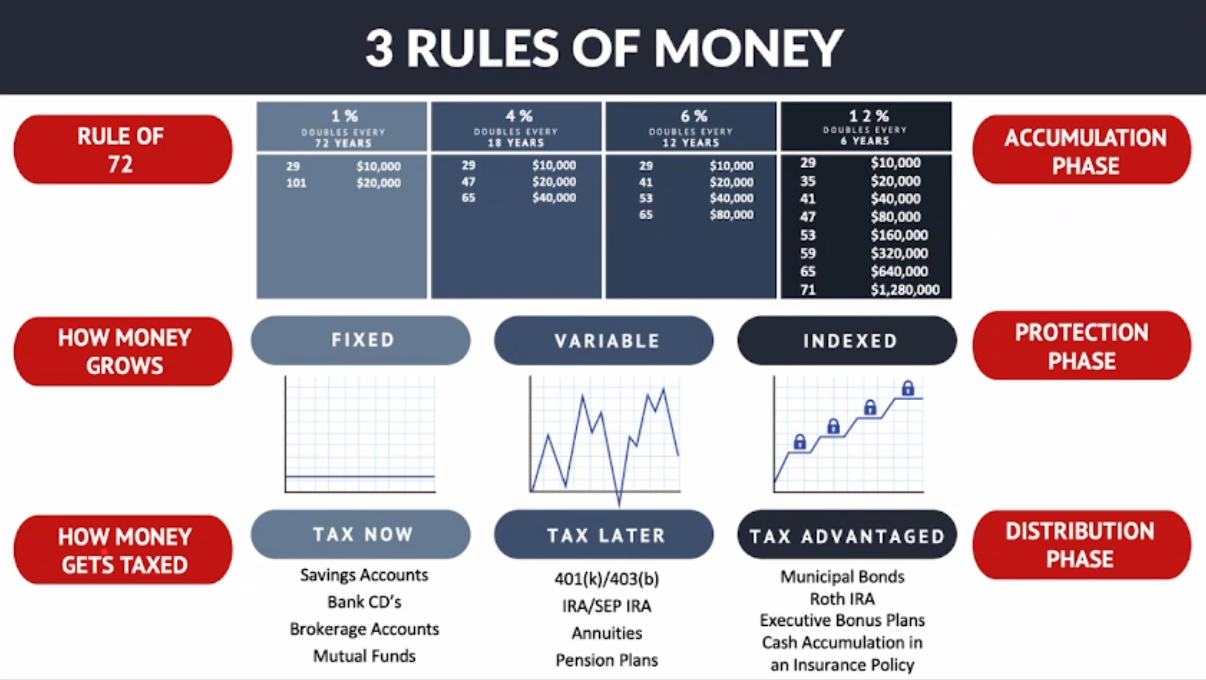

First, let’s get something straight: The 401(k) is a variable account. That means your money is tied to the stock market—up one day, down the next. You have no control over what the market does, and your future income depends on how those investments perform.

Second, the money you contribute comes from your gross income, before taxes. That might sound great now—but you’re not avoiding taxes… you’re just postponing them.

Here’s what really happens:

- You’re deferring taxes to a future date

- When you retire, you’re taxed on the full value of your account, including growth

- That means you’re paying taxes on the big harvest—not the little bag of seeds

Let me ask you:

Let’s say you’re a farmer. You plant a little bag of seeds, and over time, it grows into a huge harvest.

Would you rather pay taxes on that huge harvest at the end—or the little bag of seeds you started with?

Most people would choose the bag of seeds—because that’s far less in taxes.

But with the 401(k), you’re doing the opposite. You’re giving the IRS a bigger chunk later—when the account has grown.

Employer Matches: Helpful, But Not a Free Pass

Employer matches can be great—if they’re generous. A 10% match is solid. But most people get 2–3%, which barely moves the needle in the long run. And don’t forget:

- You still pay taxes on the entire balance, including the match

- The match doesn’t protect your account from losses

- You’re still locked into age-based restrictions and penalties

The 59½ Rule: Your Money Is Locked Away

Until you’re 59½, touching your 401(k) = penalties.

If you’re 35 now, that’s 24 more years where your savings are off-limits. Life doesn’t wait that long—unexpected medical bills, job loss, or a family emergency could force you to dip in early.

What happens if you do?

- 10% penalty

- You owe income tax

- You could lose up to 40% of your withdrawal

- And it’s a paperwork nightmare

The 73 Rule: Uncle Sam Still Wants His Cut

If you make it to retirement and don’t need to touch your account, the government still forces your hand. Once you hit age 73 (increasing to 75 soon), Required Minimum Distributions (RMDs) kick in.

You must withdraw—whether you want to or not.

If you don’t?

- You’ll be hit with a 25% penalty

- You’ll still owe ordinary income taxes on every dollar

- And remember: tax rates may rise in the future

So you’re forced to draw from your retirement account on their terms, and give up a chunk to the IRS either way.

Are You Gambling with Your Future?

If the market tanks or taxes go up, your retirement can take a huge hit. And with the 401(k), you have zero control over either.

Let me ask you again:

Would you start a business where you put in 100% of the money, but someone else makes 100% of the decisions?

Of course not. But that’s how a 401(k) works—you take the risk, but “the man” (the government, the market, the IRS) has the final say.

So What’s the Alternative?

Clients often ask, “If not a 401(k), then what?”

Here’s where I introduce the Indexed Universal Life (IUL) policy.

An IUL is a powerful financial vehicle that combines life insurance and retirement benefits. It’s designed to give you more control, more flexibility, and fewer surprises.

Here’s what makes it different:

- No penalties for accessing your funds early (if structured properly)

- Tax-deferred growth

- Tax-free withdrawals

- No market losses—your principal is protected

- Life insurance included

And the best part?

You’re paying taxes now on the little bag of seeds—not on the huge harvest later.

That means more control, more certainty, and more money in your pocket when it matters most.

The Missing Asset

Most people build their retirement using two tax buckets:

- Tax Now – Checking, savings, CDs

- Tax Later – 401(k), IRA

But the smartest plans use a third bucket:

- Tax Advantage – Roth IRA, IUL

That tax-advantaged bucket is often the missing piece that gives you real freedom in retirement.

Final Thoughts

You don’t have to ditch your 401(k), but you do need to understand its flaws. The key to financial freedom isn’t just saving—it’s strategic saving.

Your future is too important to leave up to chance.

Want to see how your 401(k) stacks up against an IUL? I’ll run a side-by-side comparison—no pressure, no commitment. Just clarity.

Let’s make your money work smarter for your future.

Leave a Reply