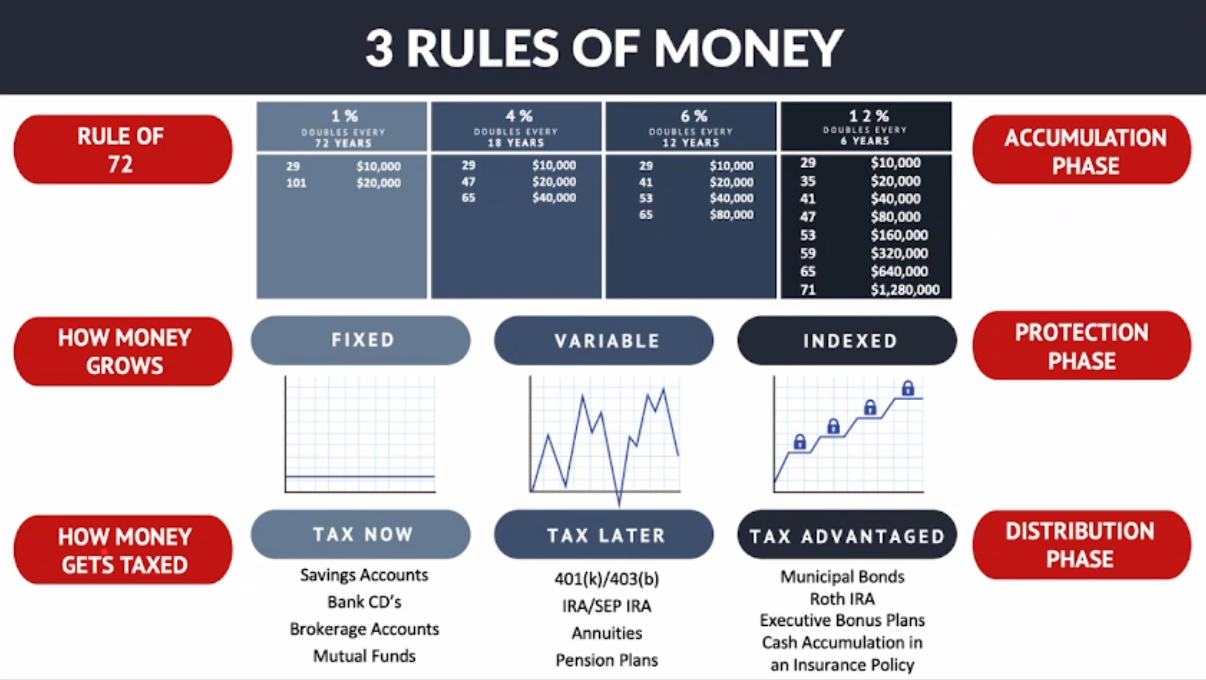

You’ve probably heard of saving through a bank, maybe even investing in the stock market or your 401(k). But what if there was a lesser-known strategy that combined the best of all worlds—safety, growth, and tax advantages?

Let me introduce you to something powerful: the Three Circles Strategy (yes, there are four circles, but we call it “three” anyway—don’t ask me why).

🔵 Circle 1: The Bank (Safety)

Let’s start with what most people know best—the bank. It’s where your money is safe. Your principal doesn’t drop when the market crashes, but here’s the problem:

💸 Zero to little growth. Your money is “safe,” but it’s also stagnant. Inflation eats away at your savings while your balance barely budges.

🔵 Circle 2: Investments (Growth)

Next, we have investment vehicles: your 401(k), IRAs, stocks, mutual funds, real estate, crypto, gold—you name it.

Here’s the deal:

📈 High potential for gains

📉 High risk of losses

Markets are volatile. You can earn 20% one year and lose 30% the next. The growth is there, but so is the stress and uncertainty.

🔵 Circle 3: Life Insurance (The Hidden Gem)

Did you know you can save money through life insurance?

Not the typical “death benefit only” plan. We’re talking about Indexed Universal Life insurance (IUL)—a financial tool that allows you to:

✅ Grow your money tax-free

✅ Access it tax-free

✅ Pass it on tax-free

Sounds too good to be true? That’s probably because:

❌ Your bank doesn’t offer it

❌ Your job doesn’t offer it

❌ Your typical financial advisor doesn’t offer it

Yet it’s one of the most popular products in America for families building real wealth. Why? Because it offers something unique.

💡 The Only Place Where You Can Have It All

If you’re looking for:

- Safety (You won’t lose money when the market drops)

- Strong Returns (Historically averaging 8%, with upside potential up to 20-40%)

- Tax-Free Access (Withdrawals and growth are IRS-friendly)

Then IUL is the only financial product on the market that can deliver on all three.

And here’s the kicker:

🛡️ It’s protected—from creditors, lawsuits, and even divorce in many states.

🚫 No penalties when you access your money.

🚀 Funds are wired directly to you, no long waits, no long questionnaires.

🛟 Real-Life Use Cases

I personally have an IUL policy with TransAmerica. When I needed to access some funds, I simply called them and said, “I’d like a loan.” They told me how much was available, asked how I’d like to receive it (wire or check), and that was it.

✅ No taxes

✅ No penalties

✅ No hassle

You can use it for:

- Emergency fund

- College planning

- Retirement

- Generational wealth

And the money keeps working for you—even after you borrow from it. That’s the magic of compound interest without market risk.

❗ But Not Everyone Qualifies

This isn’t a one-size-fits-all solution.

To get an IUL, you have to qualify—just like with any type of insurance. Your age, health, and income all play a role. When someone asks, “How do I qualify?”—that’s the moment I know they’re ready to move forward.

I’ll usually ask a few simple questions, see if the plan is a good fit, and then walk them through the next steps.

📊 The Power of Monthly Savings

Most people say, “I can only save $100 a month.” But here’s the reality: almost every adult can afford to save $25 a week. That’s just shifting a few habits.

We help clients find their “average” savings number—because people like to feel they’re at least keeping up with the crowd. And if I can help someone save more now, that means I’m helping them have more later.

If you only save $100 when you could comfortably save $500, are you really preparing for your future? IUL isn’t just about saving—it’s about saving smart.

If you’re curious whether this could work for you, just reach out. Let’s see if you qualify. This might just be the smartest move you make for your financial future.

💬 Final Thought

When I ask people what matters most, they usually say “family.” I agree. But here’s the truth:

You’re no good to your family without your life, your health, and your money.

That’s exactly what IUL protects—your life, your health, and your wealth.

Leave a Reply