Wouldn’t you agree that in order to be good at something, you first need to understand how it works?

Let me ask you—have you ever played a sport or a board game? Now imagine this: we’re about to play, but I know all the rules and don’t tell you any of them. Who’s likely to win?

Exactly. Me.

That’s how money works. There are rules to the financial system—but most of us were never taught them. Not in school, not by our parents, and definitely not by the institutions that profit from our lack of knowledge.

As someone who grew up in a hardworking Latino family, I’ve seen this firsthand. Many of us watched our parents work multiple jobs, send money back home, sacrifice, and hustle—only to still struggle financially. Why? Not because they didn’t work hard. But because they weren’t taught the rules.

That changes today.

These are the 3 basic rules of money that everyone—especially our Latino families—should know. They’re not just “good to know.” They’re essential if you want to build wealth, protect your family, and stop the cycle of financial stress.

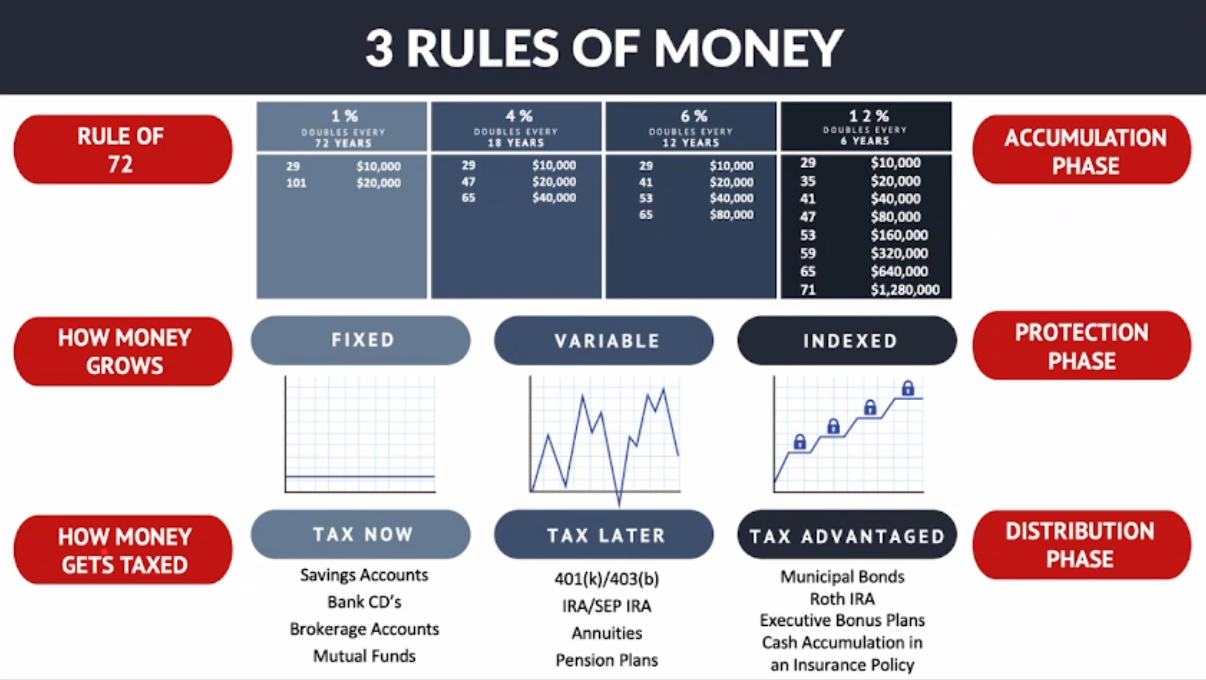

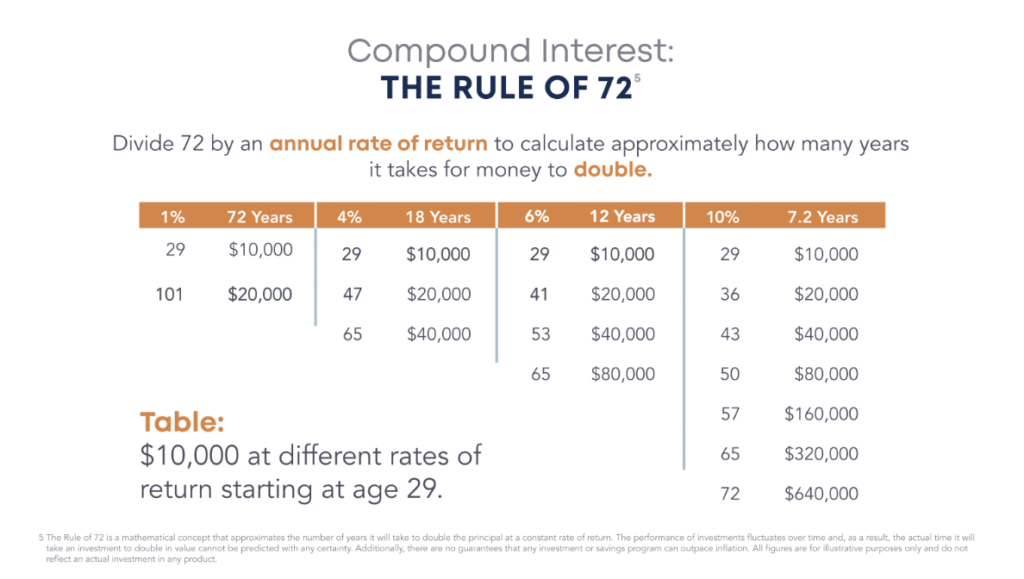

Rule #1: The Rule of 72

This is the formula for understanding how money grows.

It’s simple:

72 ÷ interest rate = number of years it takes for your money to double

Let’s break it down:

- At 1% interest (like a typical savings account), money doubles every 72 years.

- At 4%, it doubles in 18 years.

- At 6%, it takes 12 years.

- At 10%, it doubles every 7.2 years.

Let’s say a 29-year-old puts $10,000 in a savings account at 1%. By the time they’re 101 years old, it finally doubles.

But at 10%, that same $10,000 could double four times by age 65—growing to $160,000.

This is why where you put your money matters. Most people aren’t earning 10%—but they’re paying it. The average credit card rate today is over 28%. That’s money working against us, not for us.

We help families reverse that. Get out of debt. Start investing wisely. And make interest work for them.

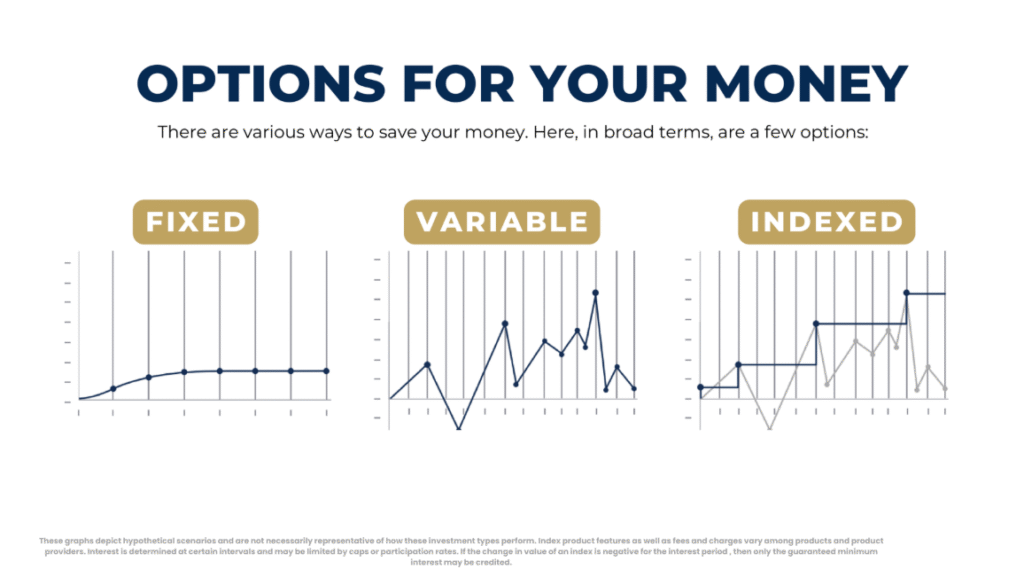

Rule #2: How Money Grows

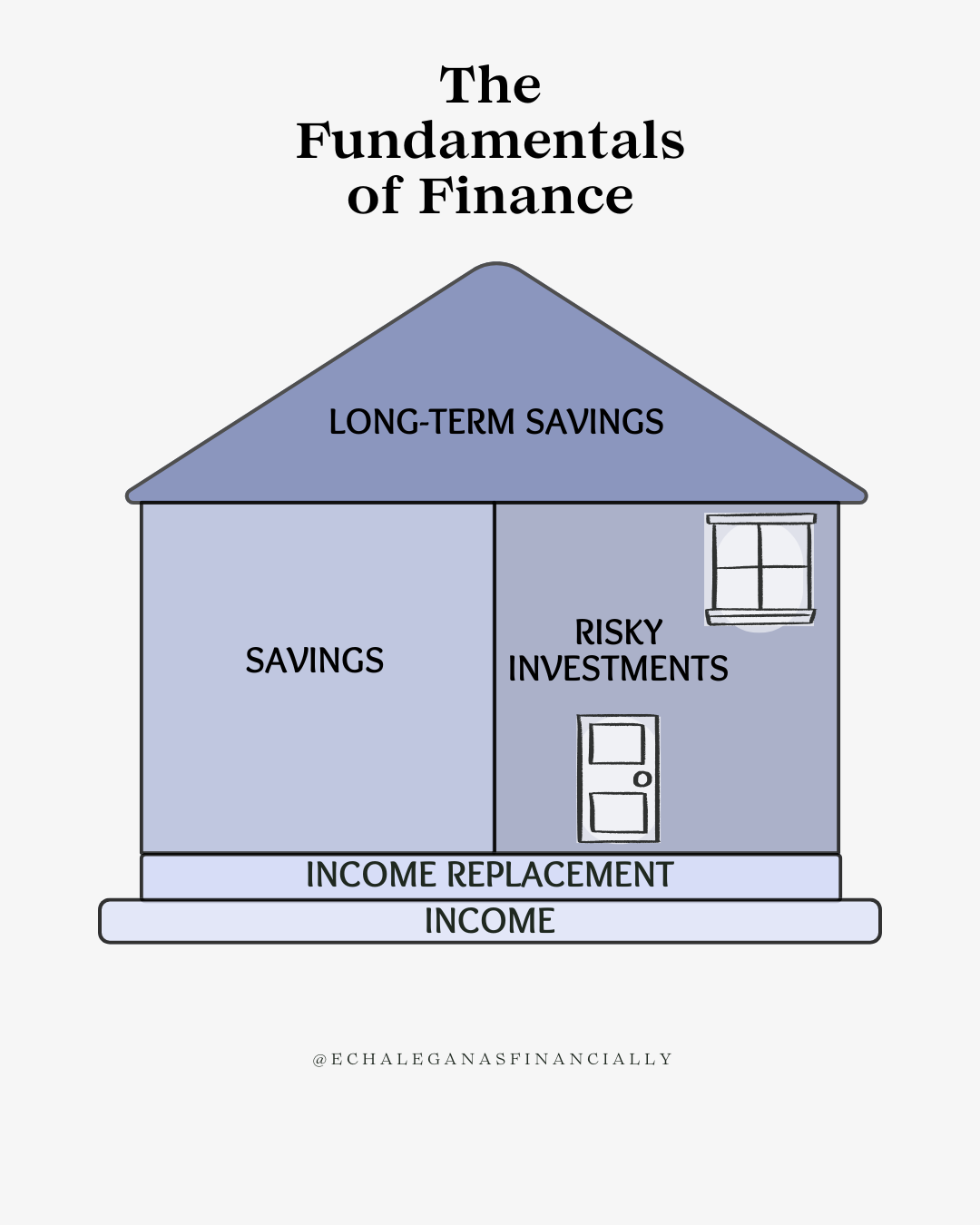

Not all financial accounts grow the same way. There are 3 main types:

Fixed Growth

These are your savings accounts, CDs, or money market accounts.

They’re “safe,” but the interest is so low it rarely beats inflation. Over time, your money loses value—even if the balance looks the same.

Variable Growth

This includes 401(k)s, IRAs, and the stock market. High potential—but high risk.

The market goes up and down. If you pull money out at the wrong time, you could lose a lot. Not ideal for people close to retirement or unfamiliar with market strategy.

Indexed Growth

This is the middle ground. It mirrors the gains of the market—but doesn’t participate in the losses.

When the market goes up, you benefit. When it drops, you don’t lose what you’ve already earned. We call this “climbing stairs instead of riding a roller coaster.”

Many financially educated families—including wealthy Latino households—are now choosing indexed strategies for long-term growth with protection.

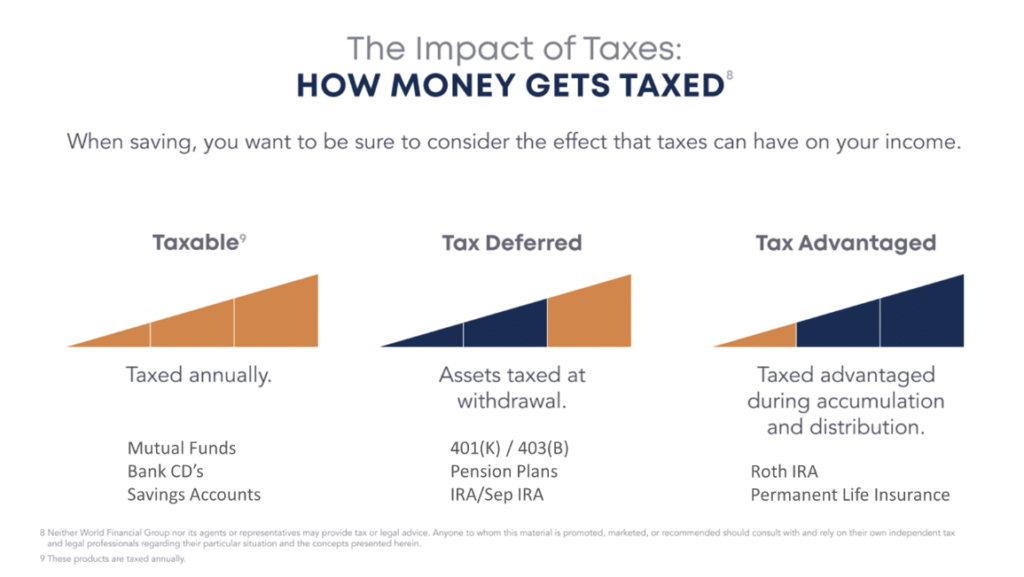

Rule #3: How Money Is Taxed

It’s not just what you earn—it’s what you keep.

There are 3 ways your money can be taxed:

Taxable

Accounts like checking, savings, brokerage, and Robinhood. You pay taxes every year on the gains—even if you don’t withdraw the money. These are “tax-always” accounts.

Tax-Deferred

401(k), traditional IRA, pensions. You don’t pay taxes now—but you will later, on everything. That includes your contributions and the growth.

Here’s the concern: if taxes go up in the future (which many experts expect due to national debt), you could pay more later than you would today.

Tax-Advantaged

Roth IRAs and properly structured indexed life insurance fall into this category. You pay taxes now, but your money grows tax-free—and you can withdraw it tax-free later.

This is the strategy of the wealthy. And it’s something our community deserves to understand and access too.

Our Families Deserve Better

Most Latino households are doing the best they can with what they know. But guess what? We weren’t meant to just survive. We were meant to thrive.

You work hard. You sacrifice. You care deeply about your family’s future. That means you deserve financial tools that help you build generational wealth—not just pay bills and get by.

That’s why I do what I do.

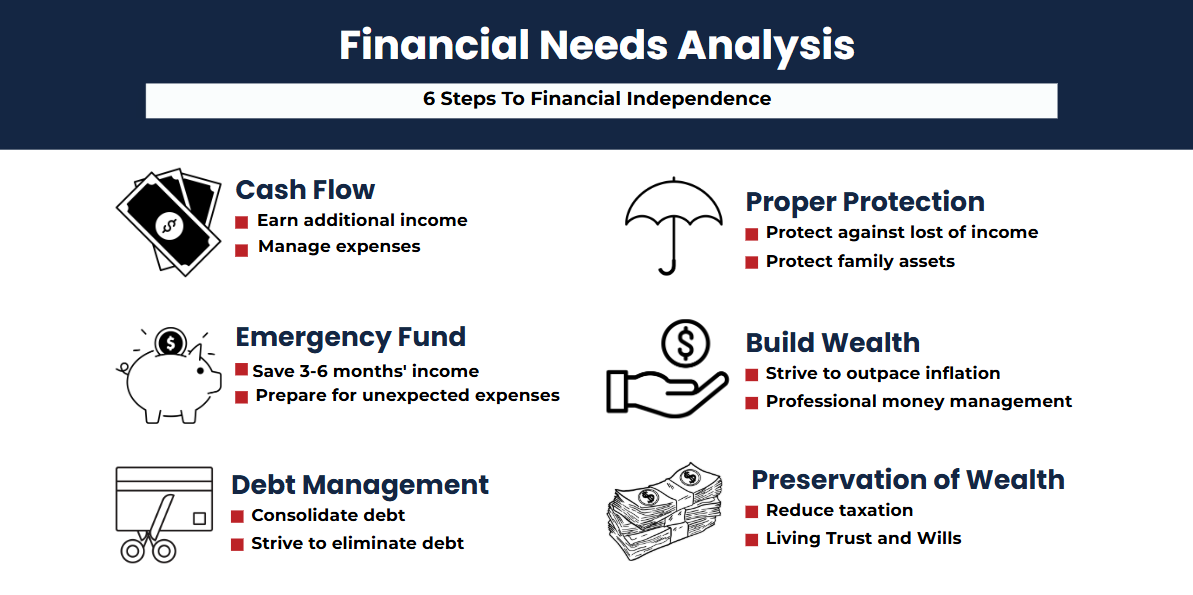

I offer free, no-obligation financial education—customized for your situation. We walk you through a Financial Needs Analysis (FNA) to help you:

• Get out of debt

• Protect your income and family

• Start building wealth

• Stop overpaying in taxes

• Understand your options

Because when you know the rules, you can start winning the money game.

Let’s Talk

Whether you’re just getting started or want a second opinion on your financial plan, I’m here to help—judgment-free and bilingual.

Send me a message, drop a comment, or schedule a free workshop for your family, church, or community group.

Let’s make sure your money starts working for you—not against you.

¡Sí se puede!

—

Kimberly Cepeda

Financial Coach | Real Estate Investor | Latina Entrepreneur

Helping families build wealth through education & empowerment

Leave a Reply