Are you watching your hard-earned money slip through your fingers? If your savings are tied up in a 401(k), an old IRA, or sitting vulnerable to market swings and tax traps, you’re not alone. Many Americans are unknowingly leaving their financial futures exposed—without even realizing it.

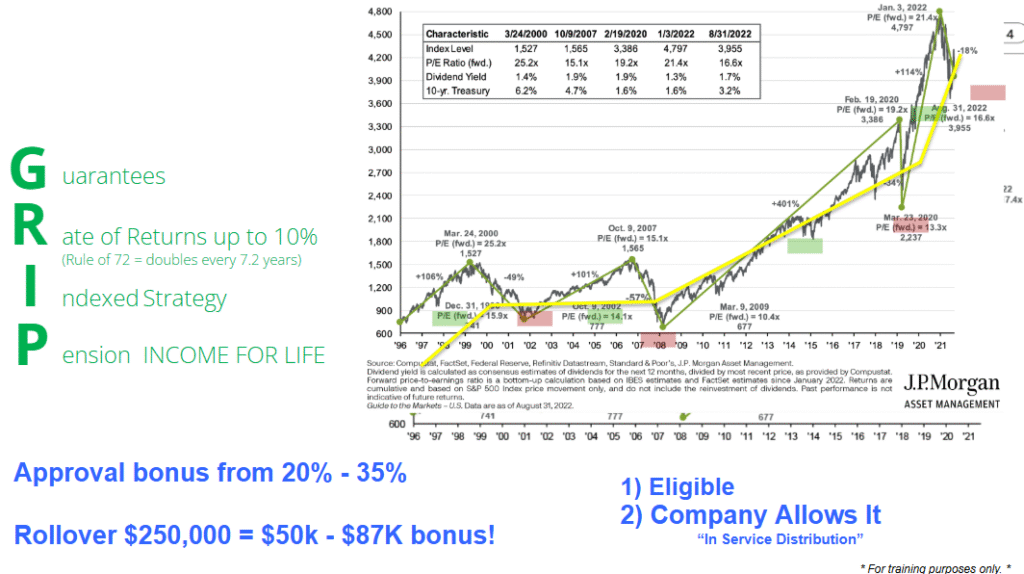

That’s where GRIP comes in. It’s a simple concept we use to help families and individuals get a GRIP on their retirement money. What does it stand for? Guarantees. Returns. Income. Protection. And it all points to one powerful solution: the Fixed Indexed Annuity (FIA).

The Problem: Your Money Isn’t Safe Where It’s At

Let’s face it—your 401(k) or traditional IRA might be growing, but it’s not protected. At any moment, market volatility could wipe out years of savings. And when it comes time to withdraw those funds, you’re almost guaranteed to pay taxes—and penalties if you’re under 59½.

So ask yourself:

What guarantees do you currently have in your retirement accounts?

Let’s break it down:

- Are you guaranteed protection from market losses?

- Are you guaranteed a reliable income stream for life?

- Are you guaranteed to avoid early withdrawal penalties or tax burdens?

Chances are, the answer is “no” to all of the above.

The Solution: Fixed Indexed Annuities (FIAs)

Fixed Indexed Annuities are designed to protect your money while still allowing it to grow. Here’s how they give you a strong GRIP:

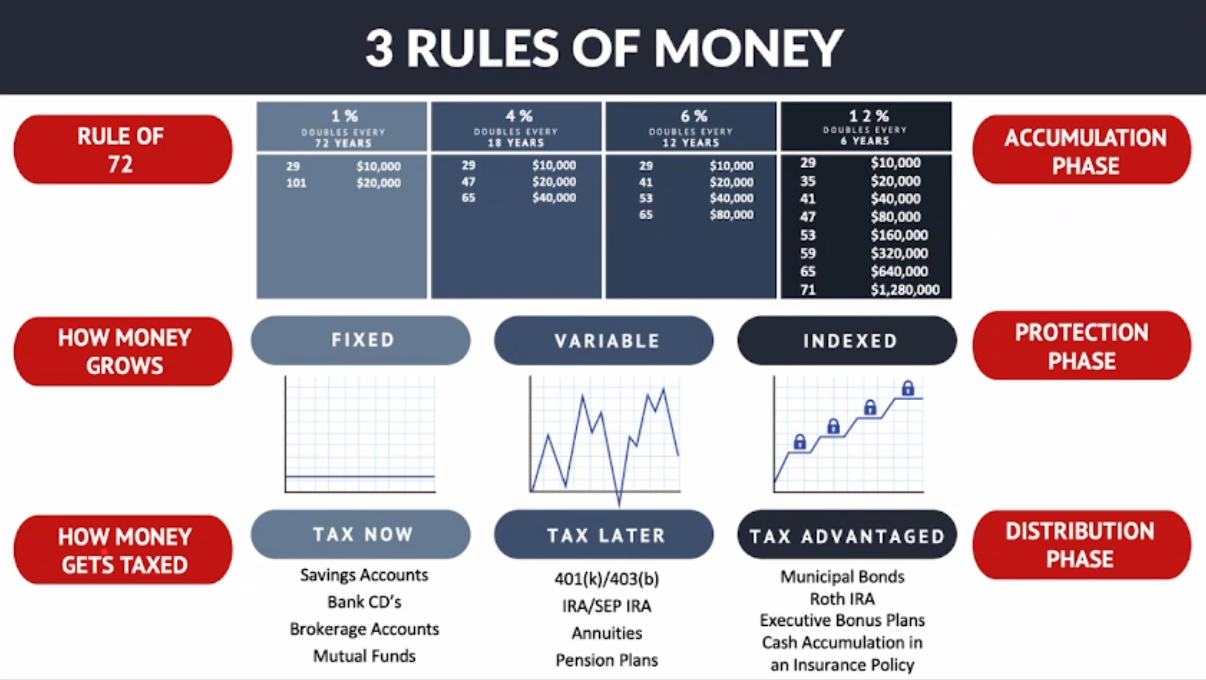

- Guarantees – You’re guaranteed never to lose money due to market downturns.

- Returns – Your money grows based on the performance of an index (like the S&P 500), but without being directly invested in the market. That means potential growth without the downside risk.

- Income for Life – You can create a stream of retirement income that you can never outlive.

- Protection – Not only is your money shielded from market crashes, but many annuities also protect your funds from creditors, lawsuits, and sometimes even divorce (depending on your state).

In some cases, you may even qualify for a bonus—often ranging from 20% to 35% of your initial deposit—just for moving your money into a fixed indexed annuity. That’s an instant boost to your retirement.

Example: Rolling over $250,000 could earn a $50,000–$87,000 bonus, turning it into $300,000+ instantly, depending on the product and eligibility.

How Do You Know If You Qualify?

FIAs aren’t one-size-fits-all. You need to qualify for the product. But qualification isn’t complicated—it starts with a few simple questions. We’ll explore your goals, current financial landscape, and long-term plans. It takes less than 10 minutes to determine if this solution is right for you.

When people hear about the benefits of annuities, they often ask:

“How do I get started?”

That’s the moment we begin the process. We sit down, review your Personal Financial Review (PFR), and determine your eligibility. If it makes sense for you, we submit the application—and you take the first step toward securing your future.

Let’s Lock in Your Retirement.

With a Fixed Indexed Annuity, you’re not gambling with your future—you’re securing it. You’re saying goodbye to sleepless nights during market crashes. You’re building tax-deferred growth and guaranteed lifetime income. And you’re taking control of your financial story.

Don’t wait until your money slips away. Let’s get a GRIP on your retirement—starting today.

Want to know if you qualify? Let’s connect for a quick Personal Financial Review (PFR). It’s fast, easy, and could change your financial future forever.

Leave a Reply